...and what you can do to lessen the pain.

Most insurance cost increases are due to a combination of factors:

- Insurance rates barely changed during the 2-1/2 years of COVID because insurance carriers assumed most people stayed home and there would be less drivers on the road, predicting less accidents

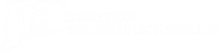

- Inflation hit new highs. Cost of labor and materials have increased substantially, which translates into higher auto premiums and Dwelling Replacement costs. TIP: If you add up your A, B, C and D coverage limits on your home, you’ll find the company may have actually raised these limits, which will account for some of the premium increases

- Accidents were often more severe and costly when people started driving again after COVID

- Insurance carriers are now attempting to recuperate from losses during this period (for every $1 a company took in, they paid out $1.13)

- Companies 'keep bumping the rates up' because they are losing money -- the industry Homeowner's market combined ratio was at 110% in 2023 and Auto was at 105%... In other words, for every $100 dollars they take in, they lose $10 (home) and $5 (auto). The alternative is companies will leave the state, leaving less competition and potentially higher rates.

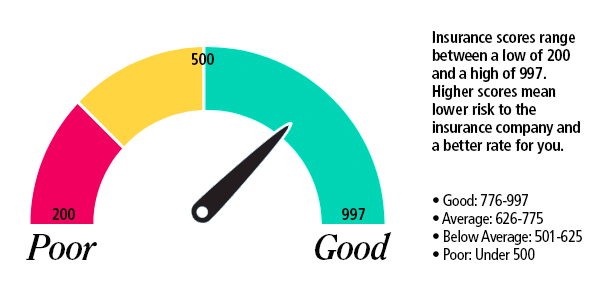

- Treat your auto and home insurance like it is a "Major Medical" policy. Think about the potential claim amount before you submit it to your insurance company as they may use 'little' or 'insignificant' claims to increase your renewal rate even more or possibly cancel your policy altogether!

- Consider increasing your deductible on your home/renters/dwelling policy

- Consider increasing your Collision deductible on your auto policy. Pro Tip: Comprehensive (AKA Other Than Collision) is usually much less costly than Collision. You would not necessarily see any significant savings by increasing the Comprehensive deductible

- Speak with your licensed insurance agent to see if you qualify for additional discounts (i.e.; if you have AAA or other Roadside Assistance, you may not want to add towing coverage on your policy; many companies provide discounts for certain levels of education and occupations; for home, many carriers provide discounts for water/temp/theft devices, as well as new roofs)

- You can shop around for better rates. An independent insurance agent like Connecticut Insurance Exchange Ltd typically represents more than one company so they can compare rates for you, saving you time and money.

- CAUTION: If you do decide to move your homeowner's insurance policy to another company, you most certainly may be subject to another – and more scrutinizing -- home inspection as companies can use even the smallest excuse to not write or cancel due to the Hard Market climate.

Our best advice is to look at all your options and discuss it with your licensed insurance agent.

RSS Feed

RSS Feed