Uh, wrong.

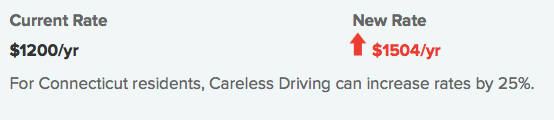

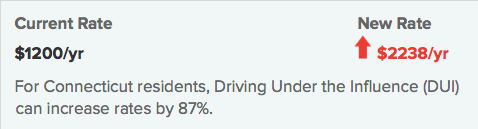

In reality it could cost you quite a lot when it comes to auto insurance premiums. A recent study looks at how moving violations can impact insurance rates. These estimated findings may surprise some drivers...

How to clean your driving record

- First, resolve to fight tickets if you think they are questionable. This will require a court visit. However, getting a violation dropped could you save you from a rate increase. But pick your battles — make sure the violations really are questionable. Mention any special circumstances. For instance, a judge might give you a break if you were rushing to the hospital because of an emergency.

- You may be able to take a defensive driving course to improve your auto insurance rate. Ask your CIE agent for details and availability.

RSS Feed

RSS Feed