- Learn how to safely use alternative heat sources and generators during a power outage: disastersafety.org/disastersafety/build-a-plan-for-a-power-outage.

- An Emergency Preparedness Kit should have three days of food, water, prescription medications and other supplies ready (ready.gov/build-a-kit).

- For current weather conditions during a power outage, consider getting a NOAA Weather Radio.

|

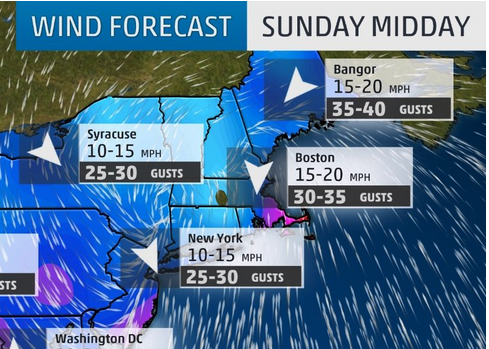

Winter Storm Harper can bring heavy snow plus high winds. And, that folks, can mean power outages. Here are tips to help you prepare:

0 Comments

If you — the insured and the occupants of your vehicle — were injured in an auto accident, who would cover medical expenses? Two coverage options are available — Medical Payments (Med-Pay) and Personal Injury Protection (PIP). Med-Pay covers the insured, family members and passengers in a covered car for medical and funeral expenses (subject to per person policy limits below) if they are injured in a car accident by a vehicle designed principally for use on public roads regardless of who is at fault (1). It also pays medical and funeral expenses arising from the accident including accidents in which the victim is a pedestrian or bicyclist. Med Pay also covers ambulance transportation, which is NOT covered under an auto policy. In Connecticut, Med-Pay Limits apply per person and range from $1,000 to $10,000 for Personal Auto Policies and from $5,000 to $25,000 per person for Commercial Policies. PIP provides the same coverage as Medical Payments for your medical expenses in the event of a claim without regard to fault (2). However, PIP can also provide lost wages, transportation expenses, and miscellaneous household assistance expenses, like cleaning or lawn care, while you recover from your injuries. Because PIP provides more coverage than Med-Pay, it's a little more expensive. Who would benefit from purchasing Med-Pay or PIP?

Understanding Policy Limits Minimum auto liability limits in Connecticut are 25,000 (bodily injury to one person), $50,000 (bodily injury total), and $25,000 (property damage). In many cases, minimum limits will not adequately cover losses. Considering the average cost of a new vehicle in the first quarter of 2017 was $31,400 (3), then these limits are inadequate for most people, especially when significant injuries result from an accident. Read more about policy limits here or speak with a Connecticut Insurance Exchange agent. Other Insurance Uninsured and Underinsured Motorists (UM/UIM) coverage is mandatory in Connecticut, at the above minimum limits of $25,000 bodily injury per person and $50,000 bodily injury total. UM/UIM does NOT apply to property damage. It's a good idea to purchase a UM/UIM limit equal to your own liability limits. UM/UIM protects you in the event that you and/or your passengers are injured by someone who:

|

News you can use from Connecticut Insurance Exchange covering topics ranging from your home, auto, business, liability and more.

AuthorMelanie Thomson-Tregoning is a Licensed Insurance Agent and VP of Marketing for Connecticut Insurance Exchange, Ltd. Categories

All

Archives

August 2023

|

RSS Feed

RSS Feed